The SSO (Single Sign On) Tax - Understanding the Controversy

Try OpenObserve Cloud today for more efficient and performant observability.

Get Started For Free

The SSO (Single Sign-On) tax has been a topic of discussion in the tech industry for some time now. While some argue that it's an unnecessary burden, others see it as a necessary evil. Let's understand what it is, why it's controversial, and why it's unlikely to disappear anytime soon.

Most folks are familiar with SSO in the form of Sign in with Google or Sign in with Facebook buttons on websites. These buttons allow users to log in to a website using their existing Google or Facebook credentials, eliminating the need to create and remember a new password for each site.

Two broad forms of SSO include:

While social logins are free for services providers to implement and provide as well as users to use, enterprise SSO solutions like Okta are not free for users and cost a lot of money for organizations to implement and use.

Say, you are looking to use a SaaS or self hosted application and the functionality works well for you. However if you want to use single sign on (SSO) to manage access to the application, you will have to pay extra for it. This extra cost is what is referred to as the SSO Tax. The term SSO Tax was popularized by Rob Chahin when he created the website https://sso.tax/ to highlight the phenomenon.

He argued that SSO should be a basic feature and not an add-on that requires additional payment primarily due to the fact that it's not a value add or convenience feature but a basic security feature and any vendor that is essentially charging separately for it does not care for security of their customers.

The SSO tax has sparked debate among tech enthusiasts and business leaders alike. Some argue that it's unfair to charge customers extra for a feature that's become a standard expectation in today's digital landscape. Others claim that the added cost is justified, given the complexity and value that SSO solutions bring to the table.

Despite the controversy surrounding the SSO tax, it's unlikely to disappear anytime soon. Here's why:

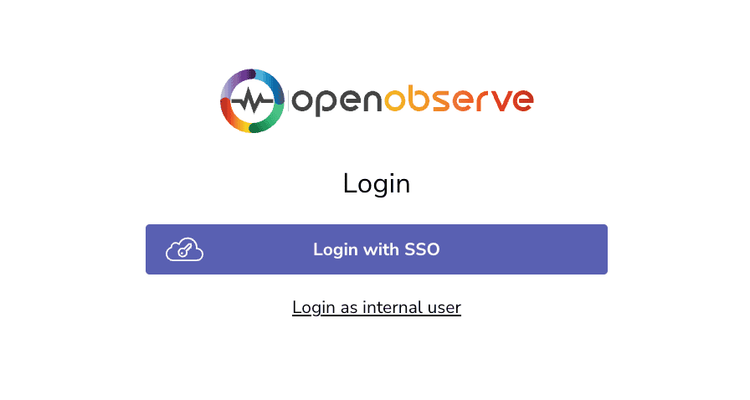

At OpenObserve, we understand the importance of SSO. We believe that SSO is critical for ensuring seamless access to our platform and integral to improving security, which is why we strive to provide SSO capabilities to most of our customers at no additional cost.

For our cloud service we provide SSO in our free tier for following providers with plan to support more in future:

SAML and OIDC are available in our enterprise tier.

For self hosted version of OpenObserve, SSO is available in the enterprise version, which is available to anyone for free who ingests less than 200 GB of data per day. That is 6 TB/Month of data ingestion. Most users will never hit this limit. Most startups and small businesses will never hit this limit too. Only large enterprises will hit this limit.

The way we think of it is, are you a large enterprise that is already spending a lot of money on security and SSO solutions like Okta? If yes, you should be able to pay us as well for the same level of security.

If you are a small business or a startup, you should not have to pay for security or convenience as you could use all the support you can get. You should be able to use the same level of security as large enterprises without having to pay for it that you might not be able to afford.

The SSO tax may be a contentious issue, but it's a reality that's here to stay. While some may view it as an unnecessary burden, others see it as a necessary cost for the value that SSO solutions bring to organizations. As the tech landscape continues to evolve, it's essential to understand the SSO tax and its implications for businesses and vendors alike.

By acknowledging the complexity and value of SSO solutions, we can work towards creating a more transparent and equitable pricing model that benefits both vendors and customers. The SSO tax may not be going away, but with a deeper understanding of its role in the tech ecosystem, we can navigate its implications and make informed decisions about our IT investments.

Prabhat Sharma is the founder of OpenObserve, bringing extensive expertise in cloud computing, Kubernetes, and observability. His interests also encompass machine learning, liberal arts, economics, and systems architecture. Outside of work, Prabhat enjoys spending quality time playing with his children.